5G Patent Licensing Market Hits $15B as Huawei, Qualcomm Dominate, LexisNexis Report Finds

According to a new report from LexisNexis Intellectual Property Solutions, the global 5G patent licensing market is now valued at approximately $15 billion annually. The study highlights the growing importance of data-driven portfolio analytics in shaping licensing negotiations and patent strategy as 5G penetrates industrial IoT, automotive, and infrastructure markets.

The report’s key findings

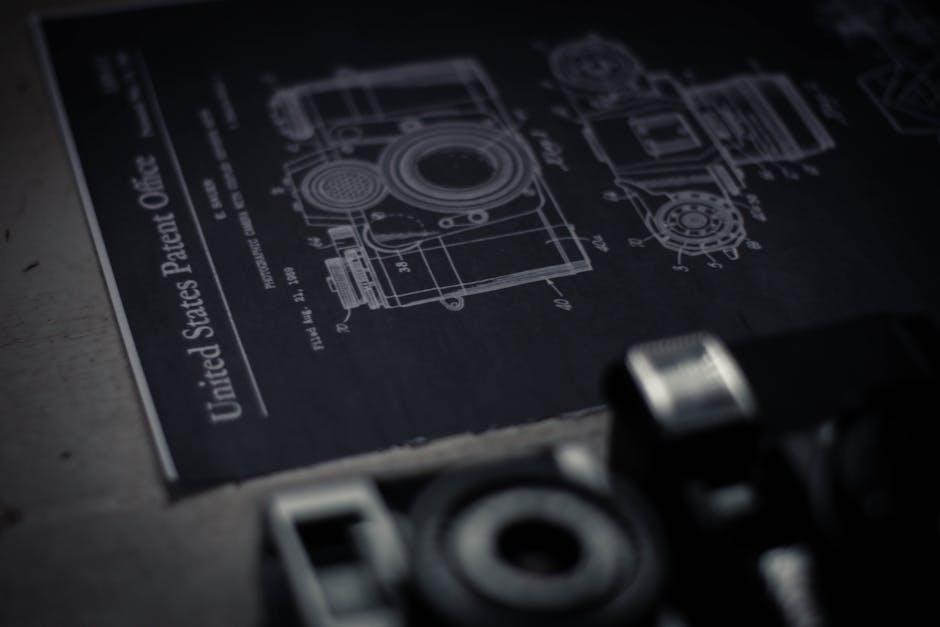

5G Standard Essential Patents (SEPs) are central to the competitive landscape, with negotiations increasingly reliant on validated data to inform Fair, Reasonable, and Non-Discriminatory (FRAND) rate-setting and litigation outcomes. LexisNexis revealed the top patent holders by value-adjusted portfolio strength and leadership in 3GPP standards contributions, identifying Huawei and Qualcomm as dominant players.

Huawei leads in terms of raw 5G patent declarations for foundational Release 15, while Qualcomm secures top position in portfolio quality and monetization, generating $5.6 billion in licensing revenue in fiscal 2024. Meanwhile, Ericsson, Nokia, and Samsung maintain significant market positions, with steady growth in their intellectual property licensing businesses over the last five years.

Implications for the telecom ecosystem

As 5G applications transition beyond smartphones into mission-critical domains like autonomous vehicles, healthcare systems, and industrial automation, the accuracy of SEP data becomes increasingly high-stakes. Tim Pohlmann, Director of SEP Analytics at LexisNexis, emphasized that discrepancies in patent portfolio rankings or essentiality assessments can materially sway licensing negotiations and financial outcomes.

The report suggests that new validation methodologies applied by LexisNexis—such as its Cellular Verified initiative and Patent Asset Index—are setting benchmarks for unbiased portfolio analysis. These rankings redefine how companies measure competitive advantage in R&D investment and intellectual property management.

What’s next as 6G looms?

With 5G adoption entering maturity and research shifting toward 6G, key players like Huawei and Qualcomm are already positioning themselves to extend their dominance into the next wireless standard. Current 6G initiatives are expected to evolve from 5G technologies, leveraging enhanced OFDM-based air interfaces for ultra-high frequency applications. While standards bodies aim for continuity in leadership, fragmentation remains a potential risk.

For telecom operators, compliance with FRAND obligations and navigating SEP complexities will be critical as patent monetization becomes a larger revenue driver. Smaller entrants in 5G and 6G ecosystems may also benefit from emerging analytics-driven tools to level the playing field in negotiations and litigation contexts.

Conclusion

The $15 billion 5G patent licensing market underscores the shifting battlegrounds in telecom revenue generation, where intellectual property has emerged as a strategic asset. With the stakes only mounting in the lead-up to 6G, will established leaders maintain their dominance, or could new challengers disrupt the balance? Share your thoughts below.