SpaceX IPO and Starlink’s Satellite Race: A Game-Changer for Global Connectivity

According to a report from GeoTel, SpaceX is set to revolutionize the telecom industry with its highly anticipated 2026 Initial Public Offering (IPO). Starlink, SpaceX’s satellite internet division, has emerged as a critical growth engine for the company, driving both revenue and innovation in satellite-based connectivity.

Starlink’s Daring Expansion: What We Know So Far

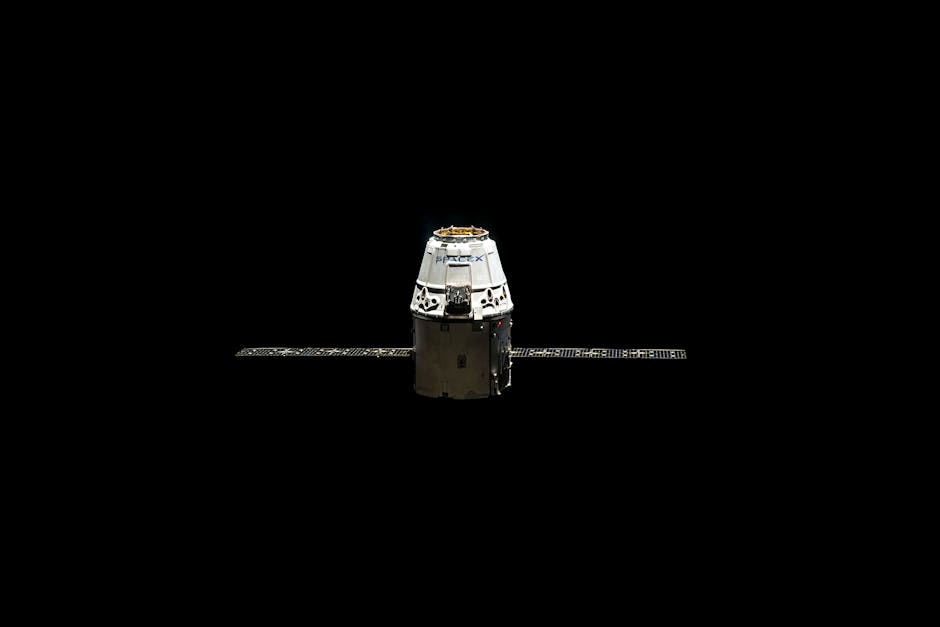

Starlink has deployed over 8,000 satellites since 2019, operating the largest satellite constellation in history. With a pace of roughly one dedicated mission per week, the system is rapidly scaling its internet capacity for underserved and remote areas globally. In December 2023, SpaceX’s valuation doubled within just five months during a tender offer, reaching estimates of over $100 billion. Analysts believe this positions SpaceX for a trillion-dollar valuation as it targets the public markets in 2026. Starlink is not merely providing internet access—its direct-to-device services and plans for space-based data centers aim to reshape connectivity paradigms for individuals and enterprises alike.

Starlink’s ambitions don’t stop at basic broadband. The company’s direct-to-cell services, targeting ordinary smartphones, and upcoming orbital data centers could redefine digital ecosystems. Orbital facilities are designed to leverage solar power and space’s cold environment for cost-effective cooling, enabling advanced computing solutions like distributed AI directly from space.

Market Context: Competitors Enter the Satellite Race

The satellite internet market is intensifying, with Amazon’s “Project Kuiper” recently rebranded as “Amazon Leo.” While currently far behind Starlink’s deployment, Amazon has mapped an ambitious schedule to launch services across the U.S., Canada, and Europe by 2026, expanding to 100 countries by 2028. The anticipated competition between SpaceX and Amazon underscores broader trends in connectivity as traditional telecom operators face new entrants in both the consumer and enterprise markets.

Even with Starlink’s clear dominance, competitors like OneWeb, Telesat, and SES are exploring niche markets and joint ventures to stay relevant. Meanwhile, airlines, enterprises, and even remote communities are signing early contracts, signaling demand that surpasses any single provider. With 2.2 billion people still lacking internet access, the stakes are high, and global broadband markets could surpass $100 billion by 2030, according to industry estimates.

Why This IPO Matters for Telecom’s Future

SpaceX’s IPO is more than a stock market event—it marks a pivotal moment in telecom innovation. Expert analysts suggest it could accelerate development timelines for high-speed, low-latency internet, bringing new opportunities for remote workers, businesses, and underserved regions. The addition of space-based data centers could revolutionize cloud computing capabilities, enhancing disaster resilience and offering faster, more reliable digital services worldwide.

Observers believe this also puts pressure on traditional telecom giants to innovate rapidly as satellite technologies start eating into their market share. This dynamic between terrestrial, floating, and satellite networks is driving entirely new ways of thinking about connectivity, from regional ground station partnerships to AI-optimized service provisioning.

The Road Ahead: Is Satellite Technology the Ultimate Equalizer?

As SpaceX barrels toward its 2026 IPO, aligned with game-changing technologies like direct-to-smartphone satellite connections and orbital AI facilities, the evolution of global connectivity is far from settled. Whether you’re a telecom provider, an enterprise decision-maker, or just an everyday consumer, SpaceX’s innovations promise a future where traditional infrastructure, satellite networks, and IoT converge to redefine digital norms. If capital raised from the IPO accelerates these innovations, the connectivity landscape could see seismic shifts globally.

What are your thoughts on how the satellite race could address connectivity gaps or reshape your digital experience in the coming years? Join the conversation below!