SpaceX’s 2026 IPO and Satellite Race Reshape the Telecom Industry

According to GeoTel, the ongoing global satellite race is poised to redefine the telecommunications industry, with SpaceX’s much-anticipated 2026 Initial Public Offering (IPO) leading the charge. Starlink, SpaceX’s satellite internet arm, has emerged as the company’s revenue powerhouse, setting the stage for what could be one of the largest IPOs in history. With a valuation inching toward the trillion-dollar mark, SpaceX is not just building satellites—it’s building the future of connectivity, launching a new competitive era in the telecom sector that pushes the boundaries of innovation and access.

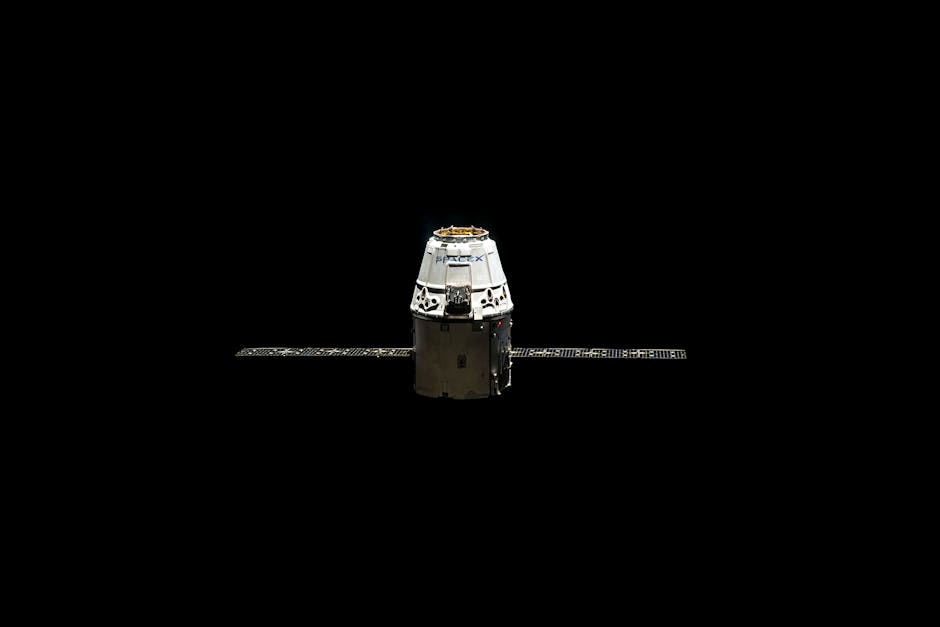

Starlink: The Revenue Engine Driving SpaceX Forward

SpaceX has deployed over 8,000 Starlink satellites since 2019, maintaining a rapid cadence of approximately one launch per week. This aggressive expansion underpins Starlink’s role as SpaceX’s most significant revenue driver, often described by analysts as the company’s “cash cow.” By mid-December 2025, insider trading valued SpaceX shares at $421, nearly doubling its valuation in a short span of five months. Experts forecast that a successful IPO could push SpaceX’s valuation into the trillion-dollar range, marking a record-breaking financial milestone.

Starlink’s innovations extend beyond high-capacity broadband. Its upcoming direct-to-device services aim to transform smartphone connectivity, allowing devices to connect directly to satellites without relying on traditional cell towers. This next phase of development is expected to launch commercially under key partnerships with major telecom providers by 2025. Additionally, the company is leveraging new satellite technology to develop orbital data centers by 2026, promising faster cloud services, enhanced network resilience, and a strategic edge in distributed computing.

Market Context: Amazon and the Intensifying Satellite Race

SpaceX’s dominance has attracted significant competition. Amazon’s “Project Kuiper,” now rebranded as “Amazon Leo,” is striving to challenge Starlink’s lead in satellite constellations. While Amazon currently has a fraction of Starlink’s satellites, the company plans to expand rapidly, aiming to deliver service across the U.S., Canada, Europe, and more by Q1 of 2026, with further global growth targeting 100 nations by 2028.

Amazon has already secured strategic partnerships—airlines like JetBlue have reportedly signed agreements for its in-flight services. While Amazon is racing to catch up, experts agree that there is substantial room for multiple players in the booming satellite connectivity market, with demand predicted to grow exponentially as 2.2 billion people worldwide remain unconnected.

For end users, this competition translates into better offerings and lower costs. Airline passengers, remote workers, and underserved rural communities are expected to benefit as SpaceX, Amazon, and other competitors scale up their operations, offering alternatives to legacy broadband services.

The Future of Connectivity: Expert Perspectives

The implications of SpaceX’s IPO extend beyond Wall Street. Analysts suggest that the capital raised will allow SpaceX to accelerate Starlink’s satellite deployment and innovate faster in sectors like direct-to-cell messaging, IoT, and space-based cloud services. Orbital data centers, in particular, represent a leap forward for edge computing, enabling services that are unhindered by ground-based infrastructure limitations. With constant solar power and the natural cooling of the space environment, these data centers could redefine the way global networks handle high-demand workloads, AI applications, and disaster recovery.

However, competitors like Amazon Leo are unlikely to remain idle. As they scale their networks, Amazon’s established cloud computing expertise via AWS opens up avenues to integrate satellite connectivity with enterprise services, potentially making it a strong competitor in the enterprise telecom market.

Looking forward, the increased launch cadence coupled with advancements in direct-to-device technology heralds a future where connectivity will be ubiquitous, faster, and more resilient. For large telecom carriers, this technological evolution pushes them to reassess their business models, creating opportunities as well as risks in an already competitive market.

Conclusion: Revolutionizing the Telecom Landscape

SpaceX’s impending IPO and its aggressive satellite strategies signal a new era in telecommunications. Beyond financial milestones, the race to connect billions of underserved people and enable cutting-edge services—such as orbital data centers and direct-to-satellite smartphone connectivity—is reshaping how we think about internet access and global networks. The question remains: how will legacy providers adapt to this rapidly evolving landscape? Share your thoughts below—are you excited for the satellite-driven internet revolution?