Is Canada’s Regulatory Environment Discouraging Telecom Infrastructure Investment?

The question of whether Canada’s telecom regulatory environment is stifling infrastructure investment is gaining renewed urgency. According to Mark Goldberg’s latest blog, Scotiabank analyst Maher Yaghi criticized the profitability of capital expenditures in Canada’s telecom sector, highlighting an industry at odds with its regulatory framework. Yaghi questioned why incumbents like BCE, Rogers, and TELUS continue to heavily invest, given requirements to share their networks with competitors at regulated, non-market-based rates.

Major Carriers Defend Infrastructure Spending Despite Headwinds

For 2026, both BCE and Rogers have signaled plans to maintain high levels of capital expenditure (capex), diverging sharply from Yaghi’s suggestions to reduce spending to levels closer to challengers like Quebecor. Industry observers note that this commitment reflects both confidence in long-term network returns and the vital role of connectivity in Canada’s digital economy.

However, Yaghi’s critique underscores the burden placed on carriers by a regulatory environment that forces network-sharing without adequate commercial incentives. In effect, every dollar invested by incumbent operators inadvertently benefits their competitors without proportional financial returns.

This tension is not new. In rejecting a 2019 CRTC wholesale rate decision, the federal government acknowledged that “these rates may undermine investment in high-quality networks.” Yet, five years later, complaints persist, raising questions about whether existing policies are sustainable in fostering Canadian telecom innovation.

Structural Challenges: A Disconnect Between Policy and Economics

The Trudeau government’s rhetoric stresses the need for private sector infrastructure investment. Announcing the formation of the Major Projects Office, Prime Minister Mark Carney and Energy Minister Hodgson framed connectivity as critical to nation-building. Yet the same government’s regulatory stance appears to inject uncertainty for telecom carriers, discouraging the kind of long-term investments it ostensibly seeks to encourage.

As Yaghi observed, Canadian carriers are contending with high levels of debt, restrictive policies, and uneven competitive dynamics. By contrast, in markets like the U.S., operators negotiate sharing terms under market-based agreements rather than regulated rates. For many policymakers, this raises the question of whether Canada should move toward a less prescriptive approach.

However, critics of deregulation argue that mandated network-sharing increases competition and affordability for consumers, particularly in underserved regions. Striking a balance between these priorities and encouraging infrastructure spending remains a daunting policy challenge.

Is Investment at Risk Without Reform?

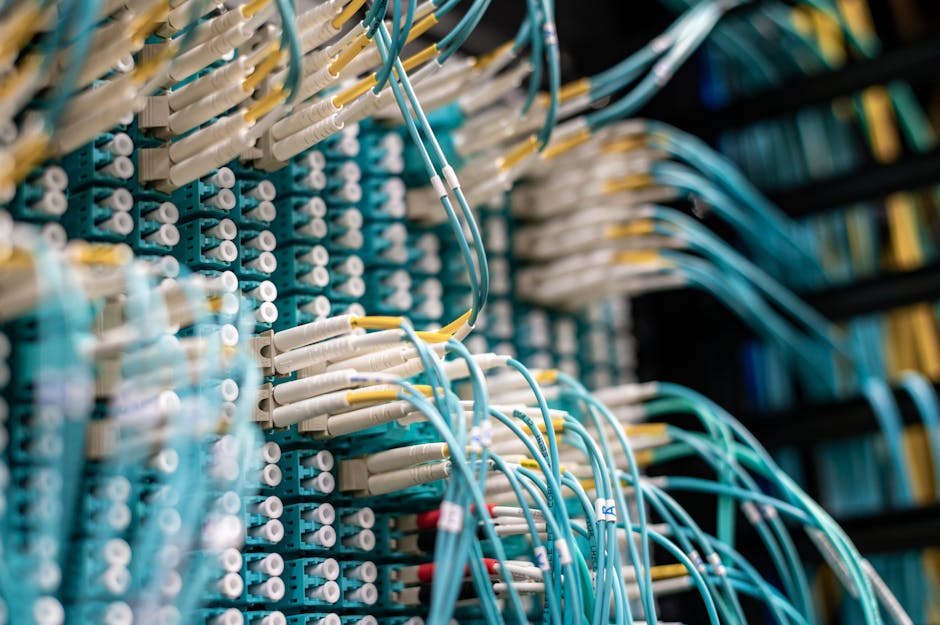

For telecom carriers, the stakes are high. Without a more predictable and equitable regulatory framework, experts warn that major infrastructure expansions could slow, jeopardizing Canada’s digital economy ambitions. A retreat from investment by incumbents could also weaken the nation’s preparedness in areas like 5G or broadband access, key pillars of global competitiveness.

For context, telecom capex totaled approximately $11 billion in 2025, much of it devoted to deploying 5G networks and rural broadband expansion. A significant reduction would not only affect consumers and businesses but could also ripple across industries reliant on high-speed connectivity.

Whether Canadian policymakers can reconcile regulatory oversight with the need for robust industry investment remains to be seen. As Goldberg notes, “Canada’s future depends on connectivity”—but industry observers are increasingly skeptical that current policies will deliver it. Will Canada risk falling behind global peers, or can regulations be aligned to drive growth?

Read the original analysis at Mark Goldberg’s blog.