Africa-Japan Partnership in Sustainable Development

TICAD 9 – the ninth Tokyo International Conference on African Development – comes at a pivotal moment for Africa as it strives to bridge significant investment gaps and bolster resilience to economic and climate shocks. The African Development Bank (AfDB), the continent’s largest multilateral lender, is poised to lead this transformation, enlisting international support from long-standing development partners like Japan.

The AfDB will host a series of side events at TICAD 9 aimed at attracting Japanese investment in green hydrogen, Mission 300, transportation, health, agriculture, and education. With aligned priorities – including sustainable infrastructure, green growth, and private sector development – the AfDB and Japan are advancing a shared vision for inclusive, resilient growth across the continent.

Strategic partnerships with Japanese agencies – such as Japan International Cooperation Agency (JICA), Japan Bank for International Cooperation (JBIC), Nippon Export and Investment Insurance (NEXI) – complement the AfDB’s “High 5” development goals by advancing projects in energy, transport, health, and climate resilience.

Japan’s enduring partnership with the AfDB traces back to 1973, when it joined the African Development Fund (ADF), the bank’s concessional window focused on Africa’s most vulnerable economies. In 1982 Japan deepened its engagement by becoming a non-regional shareholder of the bank, solidifying a bilateral relationship rooted in trust, innovation, and long-term thinking.

Decades of strong economic cooperation have seen this alliance evolve into a robust platform for development finance, knowledge exchange, and private sector engagement. Through initiatives like the Enhanced Private Sector Assistance (EPSA), launched in partnership with the AfDB in 2006, Japan has facilitated around $9bn in co-financing for African businesses and infrastructure projects.

Japan has also lent its support to initiatives aimed at accelerating human capital development and driving institutional reform across Africa. Through the Policy and Human Resource Development Grant (PHRDG), Japan’s government has funded and coordinated skills development and capacity-building programmes across ministries, academia, and civil society in multiple African nations.

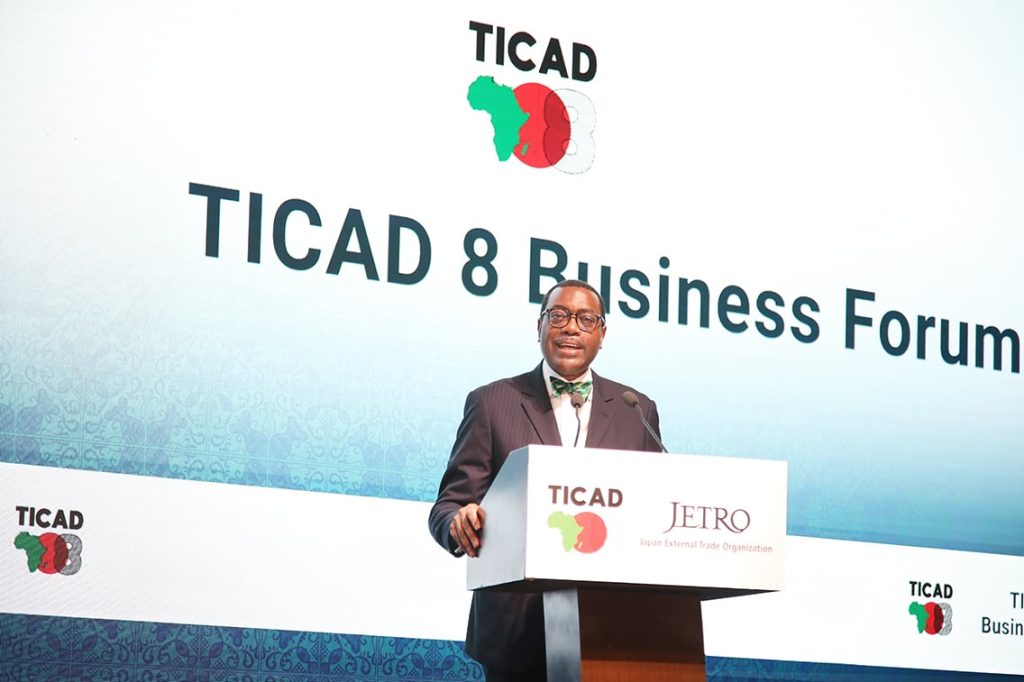

“Over the past three decades, Japan has contributed JPY 5.3bn ($37.4m) to the PHRDG, supporting 107 projects, with 96 completed and 11 ongoing as of September 2024,” noted Akinwumi Adesina, the AfDB’s outgoing president, in October last year at an event in Tokyo commemorating PHRDG’s 30th year of operation.

Japan hosts the AfDB’s sole external representation office outside Africa, highlighting its role as a critical diplomatic and economic partner in the Asia-Pacific region. The Asia External Representation office, located in Tokyo’s financial centre Chiyoda, was opened in 2012 and serves as a strategic gateway to the region.

The office anchors the AfDB’s engagement with its four Asian non-regional member countries: China, India, the Republic of Korea, and Japan. The Tokyo office is charged with strengthening the partnership that the AfDB has with these four countries, enhancing the environment for Asian investments in Africa, and endeavoring to extend, with time, the membership of the AfDB Group to other Asian countries.

Moreover, the AfDB’s presence in Tokyo has helped it forge stronger partnerships with Japanese ministries, development institutions, and corporations – ensuring close alignment between Africa’s developmental priorities and Japan’s investment objectives.

The office played a crucial role in the TICAD 9 preparations. It has also helped the bank to proactively engage Japanese stakeholders through platforms like the Africa Investment Forum (AIF).

AIF, which was launched by the AfDB and its partners in 2018, is a fully transactional platform focused on advancing projects to bankability and financial closure. AIF replaces conference-style rhetoric with deal-focused boardroom engagements. It hosts annual “Market Days”, where investors, governments, and financiers convene in boardrooms, not merely to debate development, but to transact and seal deals.

Japan plays a strategic role at AIF, actively identifying and funding high-impact projects in key sectors. With support from the Asia Office, Japanese entities – including JBIC, JICA, private firms, and startups – are increasingly engaged in investment structuring and pipeline development. Bespoke “Japan Special Room” sessions during AIF Market Days have facilitated sector-specific engagement, particularly in energy, agribusiness, and infrastructure.

Akinwumi Adesina, who steps down as president of the AfDB in September after serving the maximum two five-year terms, has been at the forefront of coordinating the bank’s strategic engagement with Japan.

During his tenure, he led multiple high-level missions to Japan to showcase Africa’s economic potential and investment opportunities. His interactions with Japanese leaders and corporate executives have led to new financing frameworks, knowledge-sharing initiatives, and discussions centered on innovation-driven development. Importantly, several projects have moved from concept to completion, driving tangible development.

Among the projects that have materialized as a result of the AfDB’s engagements with Japan include the Menengai geothermal power project in Kenya. The electricity production project is helping the East African nation develop using clean, affordable, and sustainable energy.

Geothermal power harnesses heat from the earth’s crust to convert groundwater into steam, which then drives turbines to generate electricity. The project, which taps into Kenya’s vast geothermal reserves, will help reduce the country’s dependence on fossil fuels and combat climate change.

The project consists of three modular power plants, each with a capacity of 35 MW. The first plant, built by Nairobi-based Sosian Energy, is already operational. The second, currently under construction by Globeleq, an independent power producer operating across Africa, is expected to come on stream by the end of 2025.

Planners say that once the third plant is added in coming years, the facility will have a total installed capacity of 105 MW and generate 1,000 gigawatt-hours of electricity annually. Beneficiaries are projected to include 70,000 households in rural areas as well as 300,000 small businesses and industries.

The Menengai geothermal power project in Kenya exemplifies successful collaboration between the AfDB and Japan. The project involves key Japanese players like Toyota Tsusho Corporation, JBIC, NEXI, and Mizuho Bank. Toyota Tsusho and its group company CFAO Kenya limited secured an order from Globeleq’s Kenyan subsidiary to deliver critical components for the 35 MW facility, including steam turbines and generators.

On the finance side, JBIC inked a loan agreement with the Trade and Development Bank of Eastern and Southern Africa (TDB), committing up to $8.64m. Mizuho Bank is co-financing the transaction, bringing the total facility to $14.4m. To shield commercial lenders from project risk, NEXI has provided insurance coverage for the portion of the loan provided by private financial institutions.

Project backers contend that the Menengai geothermal project links African development needs, Japanese industrial expertise, and multilateral finance – all while advancing Africa’s shift toward sustainable energy solutions.

`Japan` and the AfDB have built an enviable model for successful multilateral cooperation at a time when globalization is fracturing and nationalism is taking root. Both the AfDB and Japan have recently undergone leadership transitions. Mauritanian Sidi Ould Tah is taking over from Adesina at the AfDB in September, while Japan’s prime minister, Shigeru Ishiba, was sworn into office in October last year.

Insiders familiar with the preparations of TICAD 9 say that the new leadership at the AfDB and Japan have reaffirmed their commitment to deeper cooperation. “Both partners are keen to expand their engagement through co-financing, technical assistance, and innovation. Areas of focus going forward are said to include green infrastructure, climate-resilient projects, digital innovation, startups, impact funds, and private sector development,” one official shared.

The relationship between the African Development Bank Group and Japan has evolved into a strategic alliance powering Africa’s development. In a changing world order, it illustrates the power of sustained, values-driven partnership in delivering measurable development outcomes. Through shared vision, financial innovation, and institutional trust, the two sides are charting a path toward a more resilient and inclusive Africa.