Applied Materials Stock Surges 11.7% as AI Chip Demand Fuels Revenue Forecast

AI Chip Boom Drives Applied Materials to 11.7% Stock Surge, Exceeding Wall Street Forecasts

Semiconductor equipment giant Applied Materials saw its stock price surge 11.7% on February 13, 2026, after reporting stronger-than-expected quarterly results and a bullish forecast, driven directly by surging demand for AI chip manufacturing tools. The company’s second-quarter revenue forecast of approximately $7.13 billion exceeded Wall Street estimates, signaling a robust and accelerating investment cycle in the foundational hardware powering the artificial intelligence revolution. This financial performance, as reported by ETTelecom, underscores a critical trend: the AI content boom is built on a physical infrastructure of advanced semiconductors, and the companies that build the tools to make those chips are now reaping massive rewards.

For AI content creators, strategists, and bloggers, this isn’t just a stock market story. It’s a powerful signal about the tangible, capital-intensive reality of the AI ecosystem you operate within. The algorithms generating your content, optimizing your SEO, and automating your workflows run on silicon manufactured by Applied Materials’ customers. This financial result confirms that investment in this hardware layer is accelerating, which means the computational power available for AI tools will continue to grow exponentially. Understanding this supply-chain dynamic is key to anticipating the next wave of AI capabilities and planning your long-term content strategy.

Behind the Numbers: How AI is Reshaping the Semiconductor Equipment Market

Applied Materials’ stellar performance is not an isolated event but a symptom of a fundamental shift. The company cited “strong demand for tools used in advanced logic and memory chips” as the primary growth driver. Let’s break down what this means in the context of AI:

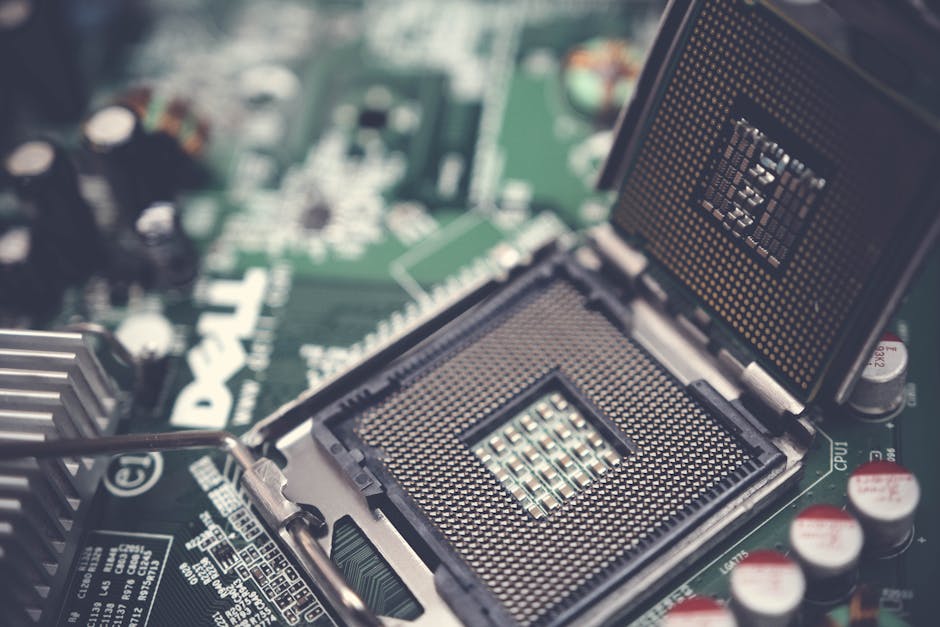

- Advanced Logic Chips: These are the brains of AI systems—GPUs from NVIDIA and custom AI accelerators from companies like Google (TPU) and Amazon (Trainium/Inferentia). Creating these chips requires extremely complex fabrication processes at the nanometer scale (e.g., 3nm, 2nm). Applied Materials provides the machines for deposition, etching, and metrology needed to build these intricate structures.

- Memory Chip Rebound: High-Bandwidth Memory (HBM) is essential for feeding data to hungry AI processors at incredible speeds. The rebound in the memory market, specifically for DRAM and HBM, directly fuels orders for Applied Materials’ equipment. AI models don’t just need fast processors; they need vast, fast memory.

- Advanced Packaging: As chipmakers like TSMC, Intel, and Samsung push the limits of miniaturization, they are increasingly turning to “advanced packaging” techniques like chiplets. This involves combining multiple smaller chips into a single package to boost performance and yield. Applied Materials is a leader in the tools required for this next-generation packaging, a segment experiencing explosive growth due to AI.

The company’s results stand in contrast to some concerns about a broader semiconductor slowdown, highlighting how AI demand is creating a “haves vs. have-nots” scenario within the tech hardware sector. Analysts from firms like LA Research noted the “significant outperformance,” with the stock hitting a new 52-week high. This surge also lifted other semiconductor equipment stocks, including industry peers like ASML and KLA Corporation, demonstrating widespread confidence in the AI-driven capital expenditure cycle.

What the AI Hardware Surge Means for Content Creators and Strategists

While Applied Materials operates in the rarefied air of billion-dollar factory tools, its success has direct, cascading implications for anyone using AI for content creation.

- Faster, Cheaper, More Capable AI Models: Increased investment in chipmaking tools leads to more advanced fabrication facilities (“fabs”). More advanced fabs produce more powerful and efficient chips. For you, this translates to the next generation of large language models (like GPT-5, Gemini Ultra, Claude 3) being trained faster and running inferences more cheaply. The tools you use—from Jasper and Copy.ai to ChatGPT Plus and Midjourney—will become more powerful and potentially more affordable as the underlying compute cost decreases.

- The Rise of Specialized AI Hardware: The boom isn’t just about general-purpose GPUs. There’s a massive push for domain-specific AI chips optimized for inference (running trained models). This specialization will lead to AI tools that are incredibly efficient at specific tasks—like SEO-optimized article generation, video script writing, or social media content creation—offering better performance at lower cost than general models.

- Content Volume and Quality Will Scale: As AI compute becomes more accessible, the barrier to producing high-volume, quality content lowers. This means increased competition but also greater opportunity for automation. Content strategists must shift focus from mere content production to strategic differentiation, deep expertise, and leveraging AI for hyper-personalization and dynamic content.

- New Content Verticals Emerge: The AI hardware boom itself is a major content vertical. There is growing reader interest in the technology behind AI. Creating content that explains semiconductors, chip manufacturing, and the infrastructure of AI (as we are doing here) positions you as a forward-thinking authority. This applies to tech blogs, investment newsletters, and B2B marketing content in adjacent industries.

In essence, Applied Materials’ revenue is a leading indicator of the raw computational power that will be available to fuel the next 3-5 years of AI innovation in content creation.

Practical Tips for AI Content Creators to Leverage the Hardware Revolution

How do you translate semiconductor earnings reports into a winning content strategy? Here are actionable steps:

- Future-Proof Your Tech Stack: Choose AI content platforms and tools that are likely to benefit from and integrate next-generation hardware. Look for providers that partner with or are built by major cloud platforms (AWS, Google Cloud, Microsoft Azure), as these companies are the primary buyers of the new AI chips. Their access to cutting-edge hardware will trickle down to their SaaS offerings.

- Develop “Hardware-Aware” Content: Don’t just write about AI software. Create content that bridges the gap between the physical and digital. Explainers on “Why AI Needs Special Chips,” comparisons of different AI accelerator offerings, or analyses of how new hardware will impact content generation speed and cost can attract a sophisticated audience and build authority.

- Automate with the Next Wave in Mind: When designing content automation workflows (using tools like Zapier, Make, or custom APIs), architect them for scalability. Assume the AI models you call will become 10x faster and cheaper in the next 24 months. Build systems that can handle a massive increase in content throughput without needing a complete redesign.

- Monitor the AI Infrastructure Ecosystem: Add key hardware players to your news monitoring list. Earnings reports from Applied Materials (AMAT), NVIDIA (NVDA), TSMC (TSM), and ASML (ASML) are not just financial news—they are bellwethers for the entire AI content landscape. A positive forecast from these companies suggests you should double down on AI investment; a warning might suggest a more cautious, quality-over-quantity approach.

- Prioritize Quality and EEAT: As AI lowers the cost of production, the internet will be flooded with competent but generic AI content. Your sustainable advantage lies in Experience, Expertise, Authoritativeness, and Trustworthiness (EEAT). Use AI to handle research and drafting, but invest human effort in unique analysis, original interviews, proprietary data, and strategic insight that machines cannot replicate.

The Bottom Line: AI Content is Powered by Physical Innovation

The 11.7% surge in Applied Materials’ stock is a stark reminder that the AI revolution has a massive physical footprint. The content we create with AI is the tip of a vast iceberg, supported by a global industry of chip designers, fabricators, and the equipment makers who supply them. For content professionals, this means our field is inextricably linked to the fortunes of the semiconductor sector.

Moving forward, the most successful AI content strategies will be those that understand this connection. By monitoring hardware trends, anticipating compute cost curves, and building scalable, quality-focused systems on top of the coming wave of AI silicon, creators and strategists can position themselves not just as users of AI, but as savvy navigators of the entire AI value chain. The message from Wall Street is clear: investment in AI’s foundational hardware is accelerating. It’s time to ensure your content strategy is built to capitalize on the wave of innovation this investment will unleash.