Arm Holdings Plunges as Plans for Own Chip Development Disappoint Investors

Arm Holdings shares took an 8% dive during after-hours trading due to quarterly forecasts that failed to meet expectations, mainly because of the company’s intention to invest in creating its chips and components.

The company projected second-quarter profits slightly below estimates, citing global trade tensions as a threat to Arm’s smartphone market. This move of intensifying in-house chip development marks a significant shift for Arm, previously known for providing intellectual property to companies like Nvidia and Amazon.

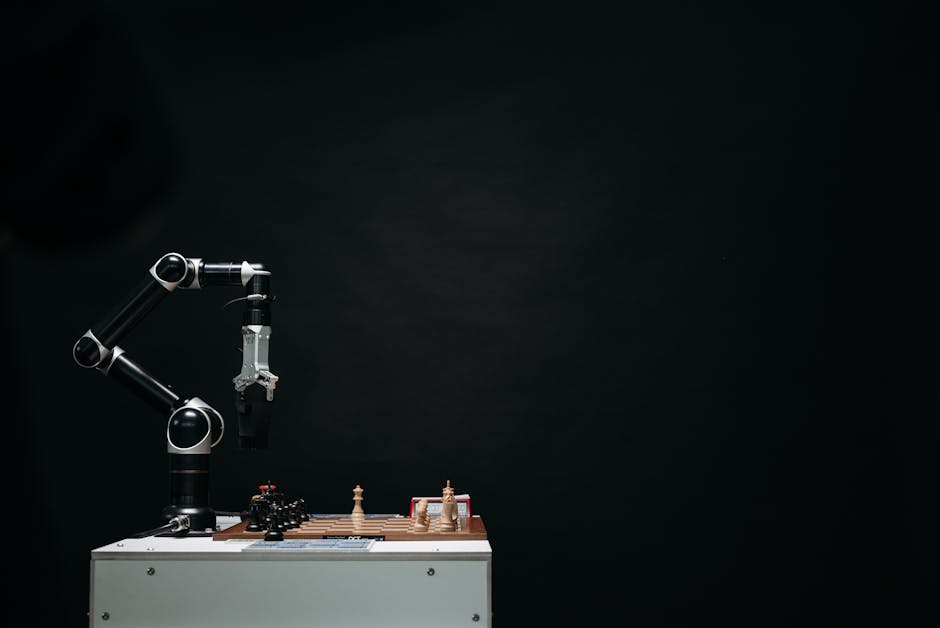

The CEO, Rene Haas, stated that they are focused on going beyond designs to construct chiplets and potential solutions. Chiplets are smaller versions of chips used as building blocks, while solutions integrate hardware and software.

Arm is increasing investments in chips and chiplets, which may or may not lead to tangible products. However, the development of a full chip could impact profits significantly, with costs soaring for advanced AI chips.

To support the chiplet initiative, Arm is recruiting staff from customers, potentially leading to direct competition with clients like Nvidia if Arm ventures into chip manufacturing.

Investor Disappointment and Forecasts

Arm’s pivotal role in smartphone chip technology faces uncertainty due to global trade challenges. The company anticipates adjusted profit for the second quarter below analyst expectations, despite a positive surge since its debut in 2023.

The market outlook is clouded by trade tensions, affecting end-market demand as demonstrated by minimal smartphone shipment growth. Forecasts for the current quarter align closely with estimates, though the company’s first-quarter sales were slightly below expectations.

Smartphone royalties are underperforming, especially in China. Nevertheless, cloud-server and AI accelerator design wins are driving the company’s revenue stream.