AT&T Completes $5.75B Acquisition of Lumen’s Mass Markets Fiber Business

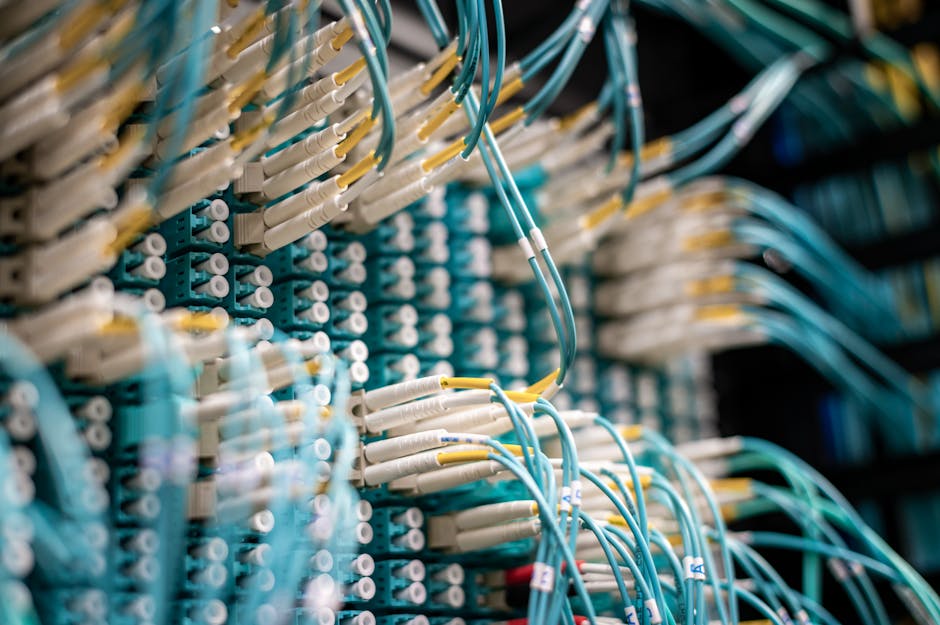

AT&T has finalized its $5.75 billion acquisition of Lumen Technologies’ Mass Markets fiber business, according to an announcement on Monday. The deal, which includes more than 4 million customer locations and over 1 million fiber subscribers across 11 states, significantly bolsters AT&T’s fiber network and customer base.

Fiber Expansion Aimed at 60 Million Locations by 2030

The acquisition is a critical milestone in AT&T’s long-term fiber expansion strategy. With this transaction, the telecom giant plans to extend its fiber footprint to cover more than 60 million locations by the end of 2030, expanding access to high-speed internet in 32 states. The company’s CEO, John Stankey, emphasized that the deal not only increases connectivity but also positions AT&T as a stronger competitor in the U.S. broadband market.

“AT&T Fiber, America’s best and top-rated technology for getting on the internet, will be available to millions more people,” said Stankey, who also highlighted the dual benefits of fiber broadband and 5G wireless services bundled under one provider. The strategy aims to improve customer retention and drive higher revenues through converged offerings.

Competitive Implications for the Telecom Sector

The acquisition accelerates AT&T’s ability to compete more effectively against rivals like Comcast and Charter, both of whom have dominated the U.S. broadband market. By adding over 1 million new fiber subscribers, AT&T is projected to gain a competitive edge in areas underserved by high-speed connectivity. Industry analysts see this as a notable step in closing the digital divide, particularly in regions where fiber deployments are sparse.

This move underscores a broader trend in the industry: telecom giants doubling down on high-speed fiber connectivity to capture market share in an increasingly competitive landscape. AT&T’s ability to cross-sell fiber broadband and wireless services could attract more customers from competitors, solidifying its role as a converged service provider.

Future Outlook: Scaling Fiber Adoption

AT&T intends to rapidly integrate Lumen’s assets into its existing infrastructure while driving fiber adoption in the newly acquired regions. The company has provided little detail about regional deployment schedules, but observers expect increased investments in infrastructure upgrades and aggressive customer acquisition campaigns in 2026 and beyond.

The timing of the deal is noteworthy, aligning with the federal push for broadband expansion through initiatives like the BEAD program, which allocates billions in funding to expand fiber access. Market observers will be closely watching how AT&T leverages these opportunities to improve its market position and boost penetration rates in its expanded footprint.

As telecom players intensify their fiber strategies, consolidation activity is expected to remain high. This acquisition signals a broader shift toward fiber-first approaches that align with consumer demand for faster, more reliable broadband services.

Read more details about the acquisition here.