BSNL’s 4G Rollout Progress and MTNL’s Ongoing Financial Troubles

BSNL’s Ambitious 4G Network Rollout Gains Traction

State-owned telecom giant BSNL has taken significant steps in expanding its 4G network, potentially solidifying its position in the highly competitive Indian telecom market. Recently, the company announced the soft launch of its 4G network in Delhi through a unique network access arrangement. This approach combines a 4G-as-a-service model with a partner to immediately deliver seamless citywide connectivity while simultaneously building its indigenous infrastructure. BSNL customers in the capital now have instant 4G access on compatible devices, marking a key milestone in the company’s technological advancements.

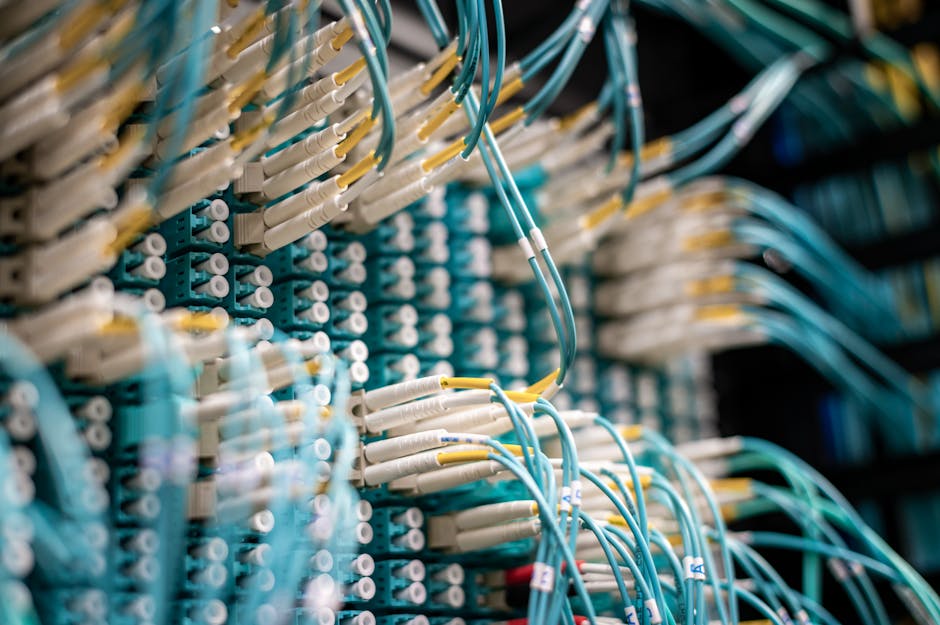

The scale of BSNL’s ongoing infrastructure rollout is staggering, with the installation of 100,000 mobile towers dedicated to 4G services already completed. Reports suggest the company plans to invest an additional INR470 billion (approximately USD $5.4 billion) to further enhance and modernize its network. Moreover, BSNL has soft-launched eSIM services in Tamil Nadu, which it plans to extend nationwide to cater to users with eSIM-compatible devices. These developments suggest that BSNL is determined to remain competitive despite the dominance of private operators like Reliance Jio, Bharti Airtel, and Vodafone Idea, who already lead with advanced 5G networks and eSIM offerings.

BSNL’s Optimistic Outlook Amid Challenges

As BSNL works proactively to grow its user base and improve offerings, its challenges remain evident. With competitors accelerating their 5G rollouts, the state-owned provider lags behind in modern technologies. However, optimism persists for BSNL, which still holds a substantial customer base of around 90 million subscribers. While the introduction of accessible 4G services and eSIM technology represents a positive trajectory, maintaining and growing this user base will require consistent upgrades to match the innovations of private sector telecoms.

BSNL’s continued focus on leveraging its investments to improve service coverage and network quality offers hope for its long-term ambitions. These efforts showcase the importance of public sector telecom operators in serving urban and rural areas and bridging digital divides in India. As it positions itself as a cost-competitive alternative in the market, there is cautious optimism about BSNL’s ability to regain its footing in the increasingly tech-driven telecom landscape.

MTNL Faces Mounting Financial Woes

While BSNL is making progress, its smaller counterpart MTNL continues to face a grim financial outlook. MTNL recently defaulted on loan repayments worth INR86.59 billion (around USD $990.48 million) owed to a consortium of seven public sector banks. The operator also failed to meet a bond repayment deadline in late August, further highlighting its precarious financial situation. With a staggering total debt of nearly USD $3.96 billion, MTNL is struggling to remain operational, despite relying heavily on government bailouts and debt restructuring moves.

Unlike BSNL, which serves the entire country, MTNL’s service area is limited to Delhi and Mumbai. Falling subscriber numbers, diminishing relevance in a competitive market, and years of mounting losses have compounded the challenges faced by MTNL. While there were discussions about merging MTNL with BSNL, those plans appear to have been shelved. Instead, BSNL has reportedly taken over MTNL’s operations. However, any turnaround for MTNL remains uncertain, as no clear strategy has been outlined to address its mounting debt or operational inefficiencies.

The Future of India’s State-Owned Telecoms

As India’s telecom market evolves, BSNL’s efforts to stay competitive serve as a potential roadmap for publicly-funded providers worldwide. By embracing innovative models like 4G-as-a-service and prioritizing investments in eSIM technology, BSNL demonstrates a willingness to adapt and grow despite financial and technological hurdles. Meanwhile, MTNL’s dire financial state underscores the challenges faced by legacy operators unable to pivot effectively in fiercely competitive markets. The contrasting fortunes of BSNL and MTNL highlight the critical importance of strategic investments, technological upgrades, and operational efficiencies in today’s telecom sector.