Fiber Deployment Costs Rise in 2025 but Industry Momentum Remains Strong, FBA Report Finds

According to the Fiber Broadband Association (FBA), the U.S. fiber broadband industry continues to expand at a historic pace despite rising costs associated with labor, materials, and permitting. The insights come from FBA’s Fiber Deployment Cost Annual Report for 2025, conducted by Cartesian, which highlights both the opportunities and challenges shaping the broadband sector in an increasingly connected world.

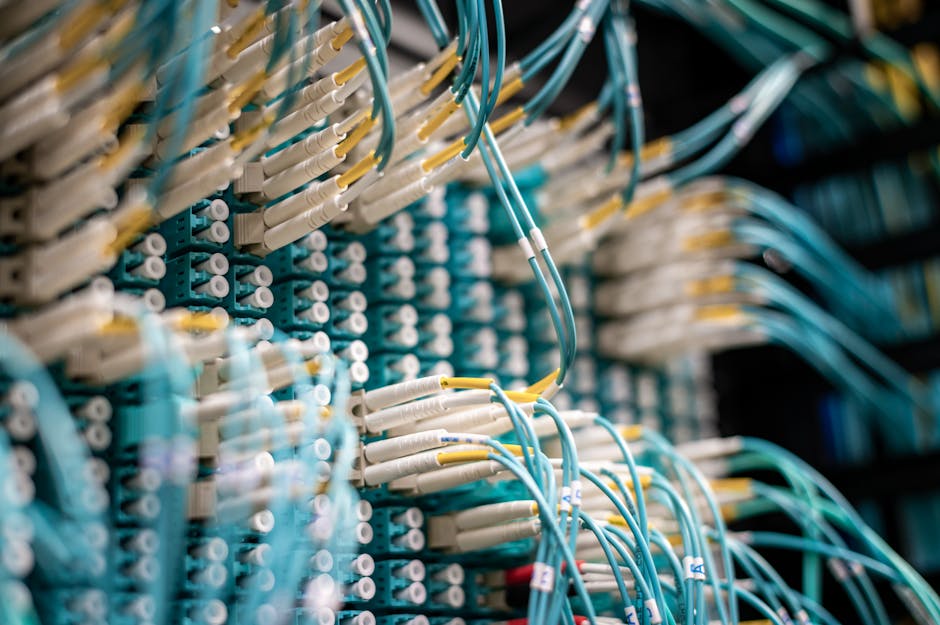

Fiber Deployment in 2025: Rising Costs and Complex Networks

The 2025 Fiber Deployment Cost Annual Report—released by the FBA and led by research from Cartesian—provides crucial benchmarks for network operators, policymakers, and stakeholders investing in America’s digital future. Among the key findings, the report notes escalating costs and deployment complexities, driven by factors such as:

- Labor Costs: With an industry-wide increase in skilled labor demand, wages have risen significantly. This contributes to higher overall deployment expenses.

- Material Pricing: The costs of essential materials like fiber optic cables have surged on the back of supply chain challenges and increased global demand.

- Permitting Delays: Bureaucratic hurdles and extended project timelines due to permitting slowdowns add new layers of risk for contractors and operators.

“Fiber is the foundation of America’s digital future, and this study confirms both its momentum and its strategic importance,” said Deborah Kish, Vice President of Research and Workforce Development at FBA. “The data equips broadband offices and network builders to plan smarter and deploy fiber solutions that endure for decades.”

Why This Matters: The Strategic Importance of Fiber

The findings underscore the critical role fiber broadband plays in meeting surging demand for high-capacity, future-proof networks. The U.S. broadband market is anticipated to grow at a compound annual growth rate (CAGR) of 8.5% from 2023 to 2030, as robust fiber infrastructure forms the backbone of next-generation applications like 5G, smart cities, and edge computing.

Though deployment costs have increased, the long-term return on fiber investments remains unparalleled. Fiber networks offer lower maintenance costs, higher reliability, and scalability compared to hybrid or legacy copper technologies. As of 2025, fiber-to-the-home (FTTH) coverage reached an all-time high of 50%, with ambitious expansion projects aiming to hit 60% by 2030. Providers betting on fiber stand to secure competitive advantages in regions where demand outpaces the capacities of fixed wireless or satellite solutions.

According to a 2024 report by Deloitte, countries with advanced fiber rollout programs, including Japan and South Korea, already report measurable economic gains in GDP, thanks to faster connectivity speeds and improved business productivity.

Expert Perspectives: Navigating an Evolving Broadband Landscape

“With rising cost pressures reshaping fiber deployment strategies, innovation in network deployment will become increasingly critical,” said Megan Corriveau, Strategy and Analytics Manager at Cartesian. Providers are turning to cost-optimization measures such as combining aerial and underground construction, streamlining permitting workflows, and leveraging modular solutions for network scalability.

Emerging technologies like artificial intelligence and advanced analytics are also enabling stakeholders to enhance operational efficiency. For instance, AI-driven planning platforms can help map out optimal routes for fiber lines, reducing construction time and costs significantly. At the same time, demand for skilled telecom workers has prompted accelerated training and certification initiatives across the industry, fueling workforce development.

Competitors in the broadband space, including satellite operators and fixed wireless access providers, are closely monitoring these dynamics. Both markets have gained traction in rural and hard-to-reach regions but lack the capacity and dependability to scale as fiber does in urban and suburban deployments. As the industry progresses, balancing fiber adoption with alternative broadband solutions will remain key for ensuring equitable connectivity nationwide.

A Resilient Future for Fiber Broadband Expansion

Despite rising costs, fiber remains the gold standard for broadband infrastructure capable of supporting America’s digital transformation. The 2025 FBA report reiterates that as network operators adapt to cost pressures, fiber deployment will continue to thrive, owing to its unmatched scalability and reliability. Policymakers and broadband offices, armed with accurate cost benchmarks, are now better equipped to guide the nation’s connectivity roadmap.

Looking ahead, innovation in deployment methodologies, streamlined regulatory environments, and broader investments in workforce training will collectively shape the trajectory of fiber adoption. With gigabit-to-terabit speeds on the horizon, the story of fiber broadband is far from over—it’s just beginning.

What are your thoughts on the future of fiber broadband? Share your perspectives in the comments below!