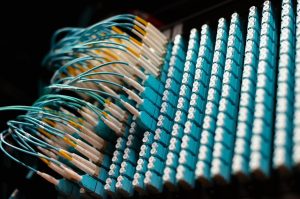

The fiber network in Africa represents the most significant infrastructure revolution on the continent since the advent of mobile telephony, fundamentally reshaping its digital landscape and economic potential. For decades, Africa’s internet connectivity was largely dependent on expensive and unreliable satellite links, creating a profound digital divide. However, the strategic deployment of thousands of kilometers of terrestrial and submarine fiber-optic cables has ignited a connectivity boom, bringing high-speed, low-latency broadband to millions. This infrastructure is the critical backbone for everything from mobile money and e-commerce to telemedicine and remote education, serving as the central nervous system for a continent poised for unprecedented digital growth. Understanding the scope, drivers, and challenges of this network is essential for grasping Africa’s future in the global digital economy.

The Evolution and Current State of Africa’s Fiber Infrastructure

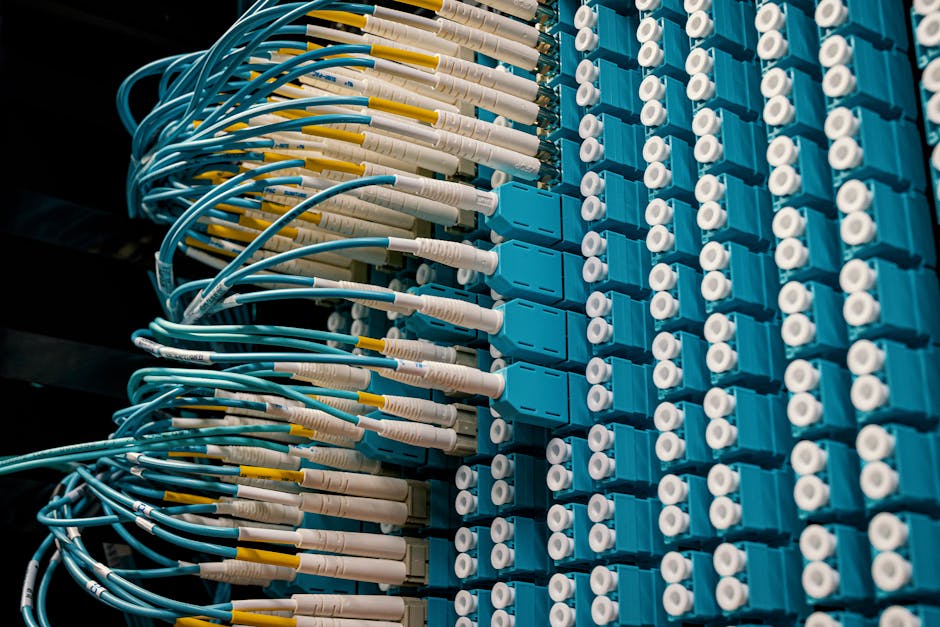

The journey of the fiber network in Africa began in earnest in the early 2000s, marking a decisive shift from satellite dependency. Pioneering projects like SEACOM, which landed in 2009, and the older SAT-3/WASC cable demonstrated the viability of submarine cables for the continent. These initial cables primarily served coastal nations, creating digital gateways but leaving vast inland regions unconnected. Consequently, the subsequent decade witnessed an explosive growth in terrestrial fiber builds, with governments and private consortia racing to construct national backbones that would link landlocked capitals and secondary cities to the coastal landing stations. This created a two-tiered architecture: submarine cables forming the international gateway and terrestrial networks distributing capacity inland.

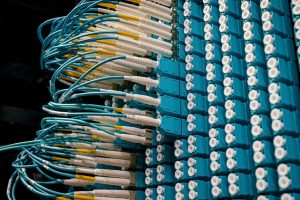

Today, the continent’s fiber map is a complex and rapidly evolving web. Major submarine cable systems like the Google-backed Equiano, 2Africa, and ACE ring the coastline, offering terabytes of potential capacity. Domestically, nearly every country now boasts a national fiber backbone operated by the incumbent telecom, a utility company, or a specialized infrastructure provider. Furthermore, cross-border terrestrial links are strengthening regional integration, with projects like the Central African Backbone (CAB) and the East African Backbone (EAB) creating digital corridors. According to the World Bank, over 1.2 million kilometers of terrestrial fiber have been deployed across Africa, though distribution remains highly uneven. For instance, South Africa, Nigeria, and Kenya have dense, competitive networks, while nations like the Central African Republic or South Sudan still rely on thin, fragile links.

Key Submarine Cable Systems Powering the Continent

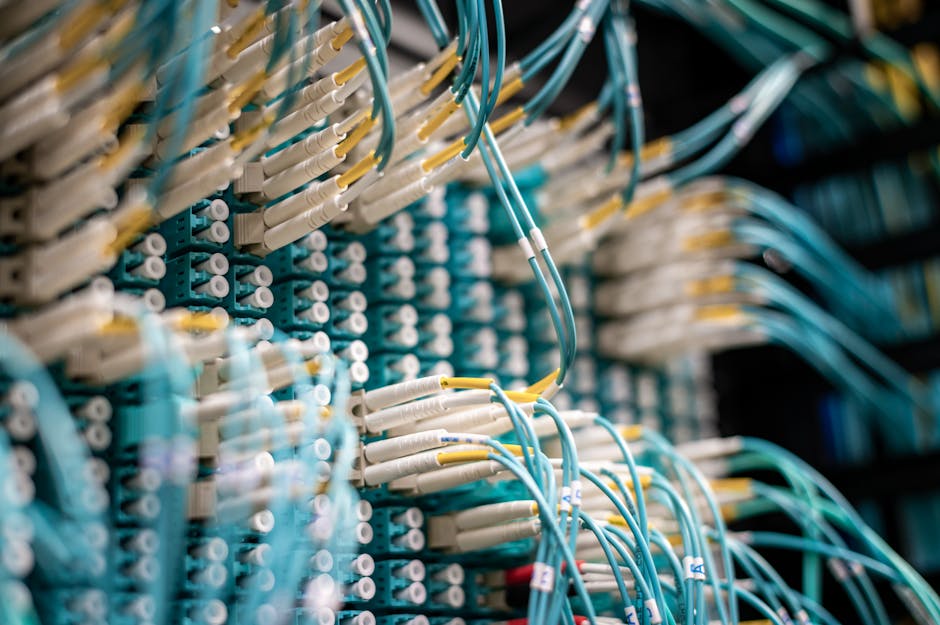

The capacity driving Africa’s internet boom originates from beneath the ocean. Modern cables like 2Africa, once fully operational, will become the largest submarine cable system globally, encircling the continent and connecting to Europe and the Middle East. Similarly, the Equiano cable, running from Portugal to South Africa, is designed with advanced space-division multiplexing technology, offering significantly higher capacity at lower costs. These new-generation cables are not just about raw capacity; they are engineered with more frequent landing points. This design directly reduces the “last-mile” distance for terrestrial networks in West and Southern Africa, lowering latency and improving reliability for end-users hundreds of kilometers inland.

Major Drivers Accelerating Fiber Deployment

Several powerful forces are converging to accelerate the build-out of Africa’s digital highways. Firstly, explosive data demand from a young, tech-savvy population is the primary market pull. The proliferation of affordable smartphones and the consumption of video, social media, and cloud services has created an insatiable need for bandwidth that only fiber can economically satisfy. Mobile network operators, in particular, are driving deployment as they transition their tower backhaul from microwave to fiber to support 4G and future 5G services, which require enormous capacity and ultra-low latency.

Secondly, strategic public-private partnerships (PPPs) have proven critical. Governments recognize fiber as essential national infrastructure, akin to roads or power grids. Many have established policy frameworks and offered concessions to private companies to build, operate, and sometimes transfer (BOT) national backbones. For example, the Ethiopian government’s partnership with the Global Partnership for Ethiopia consortium, which includes Safaricom, is a landmark deal that includes a major fiber rollout commitment. Thirdly, investment from global tech giants like Google, Meta, Microsoft, and Amazon is a game-changer. These companies are not just consumers of bandwidth; they are becoming infrastructure investors to ensure robust, low-cost connectivity for their own cloud regions and services, thereby directly funding cable systems like Equiano and 2Africa.

Critical Challenges and Barriers to Ubiquitous Access

Despite remarkable progress, the path to a fully connected continent is fraught with persistent obstacles. High capital expenditure (CAPEX) remains a formidable barrier, especially for terrestrial cross-border projects that traverse difficult terrain with low population density. The business case for connecting remote rural areas is often weak, leading to a commercial gap that public funding must address. Furthermore, right-of-way (ROW) issues and bureaucratic red tape can cripple deployment speed. Obtaining permits from numerous local and national authorities, dealing with wayleave fees, and navigating complex land ownership issues can delay projects by years and inflate costs by up to 30%.

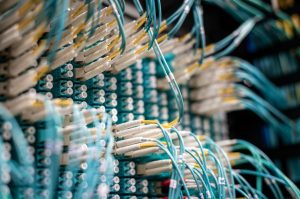

Physical security of the infrastructure is another major concern. Fiber cables are vulnerable to theft for the scrap value of the copper within, accidental damage from road construction and farming activities, and even intentional sabotage. A single “backhoe fade” incident can disconnect an entire region. Moreover, policy and regulatory uncertainty stifles investment. Inconsistent regulations across borders, restrictive licensing regimes, and unclear rules about infrastructure sharing increase risk and cost. How can operators plan long-term investments if the regulatory goalposts keep shifting? Finally, a shortage of local technical expertise for both deployment and maintenance creates a reliance on expensive foreign contractors, undermining sustainability and long-term operational efficiency.

The Transformative Economic and Social Impact

The rollout of high-speed fiber optic connectivity is catalyzing profound socioeconomic change across Africa. Economically, it directly contributes to GDP growth by enabling new industries and improving the productivity of existing ones. The World Bank estimates that a 10% increase in broadband penetration can yield a 1.38% increase in GDP growth for low- and middle-income countries. Fiber is the foundation for a thriving digital economy, powering tech hubs in Lagos, Nairobi, and Cape Town, and enabling millions of small businesses to access global markets through e-commerce platforms. It drastically reduces the cost of doing business by enabling reliable cloud services, VoIP, and video conferencing.

Socially, the impact is equally transformative. In education, fiber backbones enable digital classrooms, provide access to global academic resources, and support distance learning programs that bypass geographical barriers. In healthcare, it facilitates telemedicine, allowing specialists in urban centers to consult with patients and doctors in remote clinics, and enables the fast transmission of high-resolution medical images for diagnosis. Furthermore, fiber improves government service delivery through e-government platforms, increases financial inclusion by supporting stable mobile banking and fintech applications, and fosters social cohesion by connecting communities. Essentially, it is a powerful tool for achieving the United Nations Sustainable Development Goals (SDGs) by reducing inequalities and building resilient infrastructure.

Financing Models for Future Network Expansion

Sustaining the momentum of fiber deployment requires innovative and diversified financing strategies. The traditional model of telecom operator-led investment is now complemented by several other approaches. Infrastructure funds and private equity are playing an increasingly prominent role, investing in neutral, wholesale-only fiber companies that provide dark fiber or capacity to all service providers on an open-access basis. This model promotes competition and avoids duplication of infrastructure. Development finance institutions (DFIs) like the World Bank’s International Finance Corporation (IFC), the African Development Bank (AfDB), and regional development banks provide crucial debt financing, technical assistance, and political risk mitigation for projects that have high developmental impact but may be deemed too risky by purely commercial lenders.

Additionally, the entry of content and cloud providers (hyperscalers) as direct investors is reshaping the capital landscape. Their investments are driven by the need to secure capacity and reduce costs for their own operations, but they effectively subsidize infrastructure that benefits the entire ecosystem. Another emerging model is community-based or public utility-led investment, where local governments or electricity utilities leverage their existing rights-of-way (e.g., along power lines) to deploy fiber, subsequently leasing it to operators. Blended finance, which combines public, philanthropic, and private capital to de-risk investments in underserved areas, will be essential for bridging the final connectivity gap in rural and remote regions.

Technological Innovations Shaping the Next Generation

The future of Africa’s fiber networks will be defined by cutting-edge technologies that enhance capacity, reach, and intelligence. Firstly, advancements in fiber optic cable technology itself, such as hollow-core fiber and advanced multiplexing techniques, will continue to push the boundaries of data throughput, allowing existing cables to carry exponentially more data without the need for costly new trenches. Secondly, the integration of fiber with wireless technologies is critical for last-mile delivery. Fixed Wireless Access (FWA) using 5G mmWave or other high-frequency spectrum can provide fiber-like speeds to homes and businesses where direct fiber-to-the-premises (FTTP) is not immediately economical, creating a powerful hybrid network.

Furthermore, software-defined networking (SDN) and network function virtualization (NFV) will make networks more agile, efficient, and easier to manage. Operators can dynamically allocate bandwidth, create virtual networks for specific customers, and automate fault detection and repair, significantly reducing operational costs. The use of drones and AI for network planning and maintenance is also on the rise. Drones can survey routes and inspect cables, while AI algorithms can predict potential failures by analyzing network performance data, enabling proactive maintenance and minimizing service disruptions. These innovations are not luxuries; they are essential for building resilient, scalable, and cost-effective networks that can keep pace with demand.

The Crucial Role of Policy and Regulation

Effective policy and forward-thinking regulation are the bedrock upon which successful fiber expansion is built. Governments must move beyond simply issuing licenses and become active facilitators of infrastructure rollout. A paramount policy objective should be the establishment and enforcement of mandatory infrastructure sharing and open-access principles. This prevents the wasteful duplication of trenches and ducts, lowers market entry barriers for new players, and ultimately reduces costs for consumers. Regulators must create a clear framework for sharing both passive (ducts, poles) and active (fiber strands, wavelengths) infrastructure at fair and transparent prices.

Secondly, streamlining the right-of-way (ROW) permitting process is a regulatory imperative. Creating a single window for permits, standardizing wayleave fees, and enacting “dig once” policies—where fiber conduits are laid during any public roadworks—can dramatically cut deployment time and cost. Moreover, spectrum policy must be aligned with fiber goals. Releasing affordable spectrum for 5G backhaul and FWA complements fiber deployment. Regulatory certainty is the most valuable currency for attracting long-term infrastructure investment; consistent, technology-neutral rules that promote competition and protect investors are non-negotiable for sustaining the build-out momentum.

Future Outlook and the Path to Digital Inclusion

The trajectory for Africa’s fiber networks points toward deeper penetration, greater resilience, and smarter operations. In the coming decade, we will see a push beyond national backbones and major cities into secondary towns and, eventually, a significant portion of rural areas. This will be driven by a mix of commercial expansion, public subsidy, and universal service fund projects. The concept of regional digital corridors will gain prominence, with fiber acting as the backbone for integrated regional markets, such as the African Continental Free Trade Area (AfCFTA), by enabling seamless data flows and digital services across borders.

However, the ultimate goal remains true digital inclusion. This means ensuring that the benefits of fiber connectivity—affordable, reliable, and fast internet—are accessible to all citizens, not just urban elites. Achieving this requires a holistic approach: continued infrastructure investment must be paired with digital literacy programs, locally relevant content and application development, and policies that keep access affordable. The fiber network is the pipe, but what flows through it must empower communities. As one industry leader aptly stated,

The true measure of Africa’s fiber success won’t be in kilometers of cable laid, but in the number of lives transformed, businesses enabled, and innovations unleashed by the connectivity it provides.

The journey is far from over, but the foundation for a digitally empowered Africa is being laid, strand by luminous strand.

Key Takeaways on Africa’s Fiber Network Journey

- Africa’s fiber network has evolved from scarce submarine cables to a complex web of over 1.2 million km of terrestrial and submarine infrastructure, though deployment is uneven.

- Explosive data demand, public-private partnerships, and investment from global tech giants are the primary drivers accelerating deployment.

- Major challenges include high costs, right-of-way issues, physical security threats, and regulatory uncertainty that hinder ubiquitous access.

- The economic and social impact is profound, boosting GDP, enabling digital businesses, and transforming education, healthcare, and government services.

- Future expansion relies on innovative financing from infrastructure funds, DFIs, and hyperscalers, blended with public funding for rural gaps.

- Technological integration with 5G, SDN, and AI will define the next generation of smarter, more resilient networks.

- Supportive policy focusing on infrastructure sharing, streamlined permits, and regulatory certainty is the critical enabler for sustained growth.

- The end goal is digital inclusion, where fiber acts as the backbone for regional integration and empowers all citizens through affordable access and relevant applications.

Frequently Asked Questions (FAQs)

Which African country has the most extensive fiber network?

South Africa currently boasts the most extensive and mature fiber network in Africa, with dense metropolitan fiber in major cities like Johannesburg and Cape Town, a robust national backbone, and multiple submarine cable landings. Nigeria and Kenya follow closely, with rapidly expanding networks driven by intense market competition and high data demand.

How does fiber internet improve mobile network performance in Africa?

Fiber is essential for mobile network backhaul—the connection between cell towers and the core network. Replacing older microwave links with fiber provides the massive capacity and ultra-low latency required for 4G/LTE and 5G services. This directly translates to faster mobile internet speeds, better call quality, and the ability to support more users and data-intensive applications simultaneously.

What is the biggest threat to the stability of Africa’s fiber infrastructure?

The most persistent threat is physical damage, often termed “backhoe fade.” This includes accidental cuts by construction crews, agricultural activity, and deliberate theft or vandalism. A single cut can disconnect entire regions, highlighting the need for diverse fiber routes, robust monitoring systems, and faster repair processes to ensure network resilience.

Are satellite internet systems like Starlink a competitor or complement to fiber in Africa?

In the short to medium term, they are a powerful complement. Satellite services are ideal for providing connectivity in remote, low-density areas where terrestrial fiber deployment is not economically viable. They can serve as a stopgap or permanent solution for hard-to-reach communities, schools, and enterprises. However, for urban areas and high-bandwidth applications, fiber’s superior capacity, lower latency, and cost-effectiveness at scale make it the undisputed backbone technology.

How can local businesses leverage the expansion of fiber networks?

Local businesses can leverage fiber to adopt cloud-based services (ERP, CRM, collaboration tools), establish an online presence through e-commerce, utilize VoIP for cheaper communications, and enable remote work capabilities. Fiber-level connectivity allows small and medium enterprises (SMEs) to compete on a regional and global scale, access digital payment systems securely, and leverage data analytics for better decision-making, fundamentally transforming their operational efficiency and market reach.