Fiber Optic Vendors Prepare for Explosive AI-Driven Demand by 2026

The fiber optics industry is undergoing a seismic shift as vendors ramp up production capabilities and innovate technologically to meet the growing demand in AI-powered data centers by 2026. The surge in hyperscale AI networks has created unprecedented requirements for high-density connectivity. Notably, one major manufacturer has already sold its entire fiber inventory through 2026, signaling just how critical the situation has become. Industry leaders like Corning, STL, and CommScope are adopting multifaceted strategies to meet these demands, including manufacturing expansion, technological advancements, and stronger supply chain alignment.

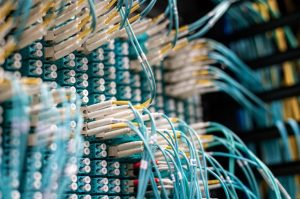

AI Networks Driving Unprecedented Fiber Demand

Pexels

The rise of artificial intelligence is reshaping data center architectures around the world. According to John McGirr, Senior Vice President and General Manager for Corning Optical Fiber & Cable, AI-driven network infrastructures demand significantly higher fiber volumes due to their reliance on GPU clusters and the need for low-latency connectivity. McGirr highlighted that next-generation AI architecture, such as Nvidia’s Blackwell GPU nodes, requires 16 times the fiber of traditional cloud switch racks. This growth trajectory shows no signs of slowing as global operators scale up and scale out their networks to meet AI processing demands.

Similarly, Rahul Puri, CEO of STL’s Optical Networking Business, projected that to support the data-intensive needs of AI, U.S. fiber infrastructure must add over 213 million more fiber miles by 2029—more than doubling the current capacity. The shift toward AI-specific fiber deployments is no longer optional, with industry leaders actively partnering with hyperscale cloud providers to ensure seamless, low-latency performance across distributed AI clusters.

Key Strategies for Meeting Market Demand

Pexels

Fiber optic manufacturers are employing a mix of strategies to prepare for the surge in demand. A primary focus has been increasing production capabilities, including expanding facilities and investing in preform production to eliminate supply chain bottlenecks. Industry players such as CommScope have invested heavily in capacity expansion, while also emphasizing innovations like pre-connectorized and modular fiber solutions designed to simplify deployments in data centers facing skilled labor shortages.

Additionally, vendors are pushing structured cabling solutions and integrated photonics to address the power and thermal challenges of advanced AI systems. Partnerships with leading hyperscalers, such as the collaboration between Corning and Lumen, have been pivotal in aligning production outputs with future requirements, ensuring robust supply chain operations in the coming years.

Technological Innovation is Key

Pexels

Technology is at the heart of the strategies being deployed to meet AI-driven fiber demand. Vendors are focusing on next-generation designs that support ultra-high bandwidth and low-latency performance. Solutions like factory-terminated, plug-and-play fiber systems and modular platforms not only reduce installation complexities but also allow for quicker deployments. As noted by industry experts, these solutions are critical for enabling the rapid connectivity needed in hyperscale and AI-driven environments.

The adoption of integrated photonics is another groundbreaking innovation under development, aimed at mitigating the power consumption and heat generation challenges posed by AI systems. Structured cabling architectures capable of meeting predictable performance metrics are becoming standard recommendations for hyperscale environments, further highlighting the industry’s focus on long-term reliability and efficiency.

Partnering for a Future-Ready Infrastructure

Pexels

The path to meeting AI-driven fiber demand hinges on strategic partnerships. Vendors are working closely with hyperscalers, data center operators, and telecom providers to co-develop infrastructure optimized for the unique needs of AI clusters. By regionalizing manufacturing and reducing lead times, the industry is aiming to strategically position itself for the massive growth projected in the coming years.

As AI adoption accelerates, the need for scalable, reliable, and high-speed fiber infrastructure will reach unprecedented levels. Companies like Corning, STL, and CommScope, with their focus on innovation and capacity building, are proving themselves to be well-positioned to support the next wave of technological transformation. The years leading up to 2026 will undoubtedly set the roadmap for how fiber optic technology underpins the global digital landscape of tomorrow.