Optical Transport Market Sees 15% Growth in 3Q2025, Driven by Cloud and DWDM Innovations

The optical transport market continues its upward trajectory, driven by innovations and increasing demand across key sectors. According to Dell’Oro Group’s recent 3Q2025 Optical Transport report, the market witnessed an impressive 15% year-over-year (Y/Y) growth. This boost highlights robust investments and technological advancements that are reshaping global connectivity.

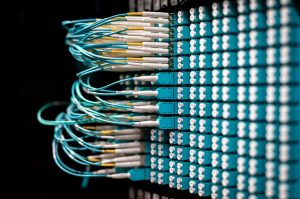

Impressive Growth from Cloud Service Providers and DWDM Technology

Pexels

The report underscores the pivotal role of Cloud Service Providers (CSPs), which saw an extraordinary 58% Y/Y growth. This surge reflects their growing reliance on advanced optical transport solutions to meet the demands of expanding cloud-based services. Additionally, the Dense Wavelength Division Multiplexing (DWDM) Long Haul segment also achieved significant growth, climbing by 24% Y/Y. These technologies are driving the global shift toward faster, more efficient long-distance data transmissions, making them central to the industry’s ongoing evolution.

Direct sales for data center interconnect (DCI) solutions played a critical role in sustaining momentum within the optical transport space. DCI, which ensures seamless integration between data centers, recorded a 34% Y/Y growth, showcasing its strategic importance to both cloud operators and service providers. Non-DCI applications also exhibited strong growth, increasing by 7% Y/Y, supported by heightened spending from communication service providers (CSPs).

Market Leaders and Competitive Trends

Pexels

Two major vendors—Ciena and Nokia—strengthened their foothold in the industry during the first nine months of 2025, each gaining more than one percentage point of market share. This growth underscores their success in meeting evolving customer needs with cutting-edge solutions. Notably, Nokia’s acquisition of Infinera earlier this year further bolstered its competitive position in the fiber optic equipment sector.

Other companies, including 1Finity, Adtran, Cisco, and Smartoptics, also reported modest gains in market share, reflecting their contributions to advancing optical transport technology. The competition among these industry players is fostering innovation, pushing boundaries, and ultimately driving down costs for consumers globally.

Comprehensive Market Insights from Dell’Oro Group

Pexels

The Dell’Oro Group Optical Transport Quarterly Report offers an in-depth analysis of the market, encompassing key metrics such as revenue, unit shipments (up to 1.6 Tbps speeds), and average selling prices. The report delves into various technology segments, including DWDM long haul, WDM metro, multiservice multiplexers, and disaggregated WDM systems.

This comprehensive coverage makes the report a valuable resource for stakeholders looking to better understand market dynamics and emerging trends. With projections indicating sustained growth in optical transport, this is a critical time for businesses to invest in cutting-edge solutions that meet the rapidly growing demands for connectivity.