Peru’s Telecom Sector Marks 3% Revenue Growth Amid Rising Internet Demand

Peru’s Telecom Revenue Grows 3% in 2025

Pexels

Peru’s telecommunications sector experienced notable growth in 2025, as reported by the country’s regulator, OSIPTEL. Total industry revenues reached SOL12.5 billion (US$3.7 billion) during the first three quarters of the year, reflecting a 3% increase compared to the same period in 2024. This growth was propelled primarily by surging demand for both mobile and fixed internet services, highlighting the increasing reliance on connectivity in both urban and rural areas within the country.

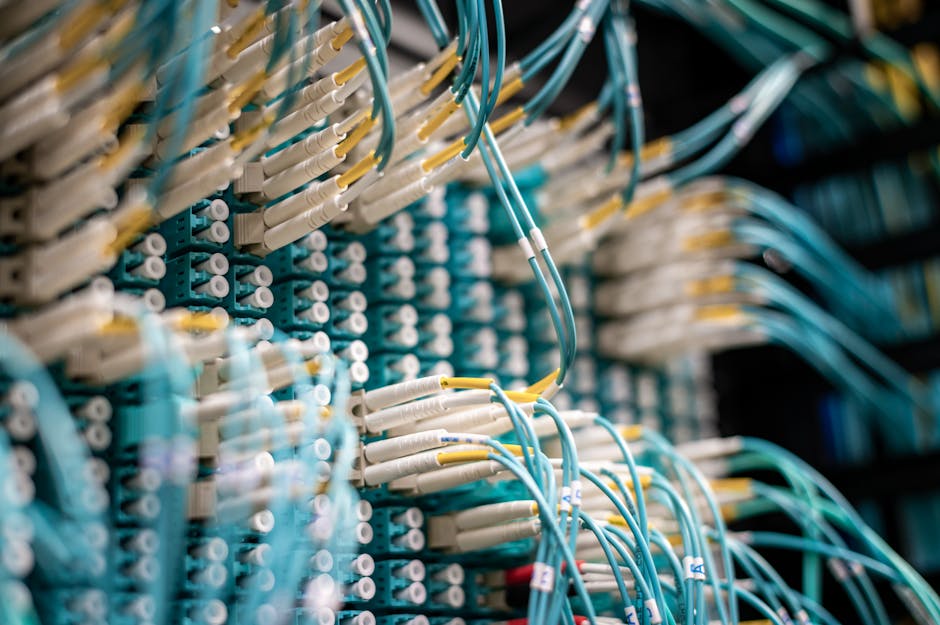

Mobile and Fixed Internet Demand Drive Expansion

Pexels

Mobile services emerged as the primary driver of revenue growth, contributing SOL7.7 billion (US$2.3 billion). Fixed internet services also played a significant role, generating SOL2.4 billion (US$713 million). The increased adoption of post-paid mobile plans has been a key factor, with the number of post-paid mobile lines climbing from 18.7 million in September 2024 to 20.3 million by the same month in 2025. Similarly, fixed broadband connections reached 4.3 million due to the nationwide expansion of fiber networks, which now account for a staggering 81% of all fixed internet connections in the country.

Market Leaders and Competition

Pexels

In terms of market share, Claro continued to dominate the telecom sector with 34.3%, followed by Integratel Peru (26.8%), Entel (19%), and Viettel-owned Bitel (10.7%). Smaller operators comprised the remaining 9.2%, indicating a highly competitive landscape. The sustained competition between key telecom providers has fostered improved offerings for consumers while driving innovation and service quality in Peru’s telecom market.

Record Investments Signal Continued Growth

Pexels

Total investment in the telecom industry reached SOL2.2 billion in the first nine months of 2025, marking an impressive year-on-year increase of 26.8%. Claro led capital investment by contributing 29.6% of the total, despite scaling down its spending by 7.4%. Other major players, including Entel (19.5%), Wi-Net Telecom (19.1%), Bitel (17.8%), and Integratel (10.4%), continued to funnel significant resources into advancing infrastructure. OSIPTEL emphasized that this upward investment trend underscores positive growth expectations for the sector, which is being bolstered by rising consumer demand, intensifying competition, and cutting-edge advancements in telecom technology.

The Future of Peru’s Connectivity

Pexels

As Peru continues to prioritize its digital transformation, the telecom sector’s robust growth is likely to persist. The expanding coverage of fiber-optic networks and innovative technological integrations will not only enhance connectivity but also serve as a foundation for economic development across various industries. With fiber now forming the backbone of fixed broadband networks and mobile services seeing strong uptake, the Peruvian telecom market appears well-positioned for long-term success.