Telecom Operators Shift Capital Towards AI Infrastructure Amid Rising Demand and Sovereignty Rules

Telecom operators are ramping up investments in AI infrastructure as data sovereignty concerns and demand for localised compute intensify, according to Omdia’s latest report, Telcos’ Strategic Investments in AI Infrastructure. This strategic pivot reflects a growing need to process AI workloads closer to users and within regulated national borders, forcing a departure from traditional data transport-centric business models.

From Data Transport to AI Compute

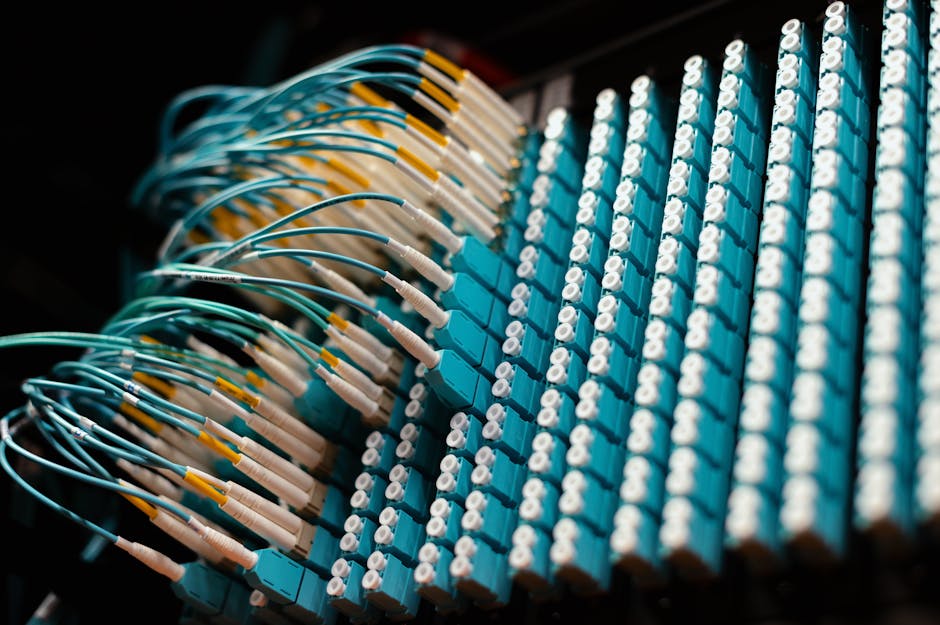

Historically, telecom operators focused the bulk of their capital on building transport networks — such as towers, fibre, and spectrum — to move data efficiently. However, as AI-driven applications proliferate, investments are increasingly directed toward modernising data centres, expanding cloud platforms, and deploying specialised AI chips and software. For instance, some operators are upgrading edge sites to process data where it’s generated, be it factories, urban areas, or public service hubs.

National initiatives and regulations are further reshaping this trend. Programs like the European Union’s AI Gigafactories aim to foster domestic compute capacity, while tightening regulatory requirements around sensitive data handling are pushing industries like healthcare, finance, and defence to rely on locally governed AI solutions. Telecom operators, already embedded in national regulatory frameworks, are uniquely positioned to meet these sovereignty demands, unlike global cloud providers.

Early Revenue Signals and Strategic Rebalancing

Although AI infrastructure investments remain in their early stages, signs of monetisation are emerging. In South Korea, AI-related data centre services accounted for 4% of SK Telecom’s revenue in Q3 2025, with plans to scale that figure to KRW 1 trillion by 2030. Similarly, Ooredoo in the Middle East aims to grow its digital infrastructure revenues from 3% of group revenue in 2025 to 12% by 2030.

To fund this strategic transformation, operators are reallocating capital from legacy connectivity infrastructure toward AI and cloud-centric platforms. Companies like STC and Iliad have established standalone subsidiaries, such as Centre3 and Scaleway, to house AI and digital assets. Others, such as Singtel, are pursuing joint ventures. Analysts note the shift is driven by stagnant returns from core connectivity services, paired with the potential for higher margins tied to AI-powered solutions like private enterprise networks, video analytics, and energy optimisation systems.

Challenges and Opportunities Ahead

Investing in AI infrastructure comes with financial and operational risks. These platforms are capital-intensive, and fluctuations in AI application demand could impact return on investment. Moreover, building and running sophisticated AI systems requires skills that many telecom operators are still developing.

That said, industry observers highlight that operators focusing on markets where AI and connectivity intersect — such as real-time analytics, fraud detection, and industrial IoT applications — are better positioned to succeed. By keeping intelligence closer to the network edge, operators reduce latency, improve efficiency, and deliver more value to customers.

As Julia Schindler, Principal Analyst at Omdia, notes, “AI infrastructure has become a key bet for telcos. The rapid growth in AI workloads, combined with national sovereignty priorities, provides a unique chance for operators to redefine their role in digital ecosystems.”

Will the Bet Pay Off?

If executed effectively, the shift to AI infrastructure could help telcos diversify revenue streams and move beyond pure connectivity competition. However, underutilised investments could strain finances, particularly as global cloud players expand their presence. What’s certain is that the traditional model, where networks simply moved data to distant clouds, is becoming outdated. For telecom operators, the future appears to lie in bringing intelligence closer to home — both digitally and geographically.

Are telecom operators poised to become the leading providers of AI-enabled infrastructure, or will global cloud giants overshadow their efforts? Share your thoughts below.